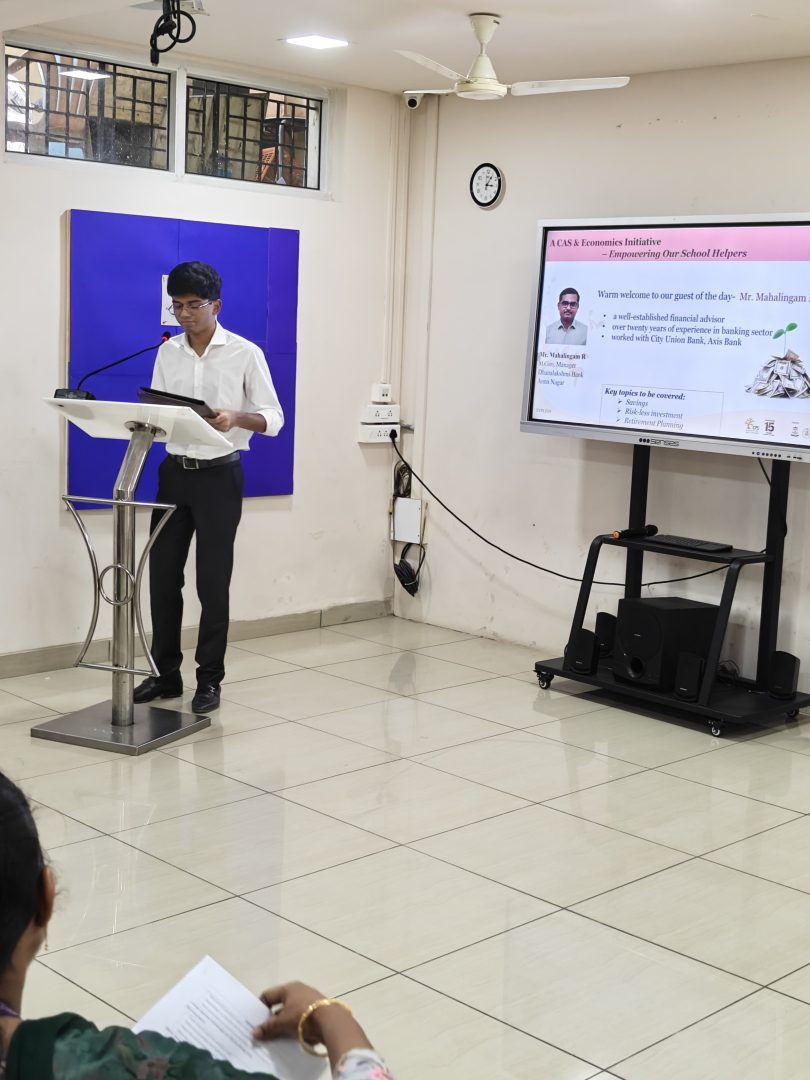

On Tuesday, our IBDP students organized a financial literacy workshop for the school’s support staff. This thoughtful initiative, a collaboration between the IB CAS (Creativity, Activity, Service) program and the Economics department, aimed to empower our school community with essential financial knowledge and skills.

Financial literacy is the ability to understand and manage personal finances effectively. In today’s world, financial knowledge is crucial for making sound decisions on budgeting, saving, investing, and managing debt. Unfortunately, many people do not have the necessary education in these areas. This initiative helped bridge the gap by providing school helpers with practical financial tools and knowledge they can use in their personal and professional lives.

The session, conducted by an expert in financial management, Mr. Mahalingam R., the manager of Dhanlaxmi Bank, equipped participants with essential skills to manage personal finances, save effectively, and make informed financial decisions. The goal was to ensure that school staff, regardless of their current financial knowledge, felt more confident and capable of managing their finances. One key focus was introducing participants to government-backed savings schemes, including the Atal Pension Yojana — a social security scheme designed to provide a steady pension to workers in the unorganized sector. Additionally, the broader community will benefit as participants pass on their newfound knowledge to their families, improving financial literacy beyond the school gates.

The workshop ended with an informative Q&A session. Afterwards, school helpers conveyed that the financial knowledge they gained from this workshop had motivated them to start saving and investing more, making it a valuable experience for everyone involved.